Meet your helper.

Adams Tax Forms Helper is still a web-based tax filing service that helps small businesses prepare tax forms.

All you need is your favorite search engine and internet access from your Mac or PC.

For businesses, big and small.

We help companies of all sizes, from CPA firms to small businesses and individuals.

Whether you’re running a business with 1 employee or 1,000, we’ll help you prepare professional W-2s and 1099s in minutes.

Better capabilities for a better tax season.

This easy interface is where you’ll build fillable, printable 1099 forms and W2s. Prepare one or hundreds.

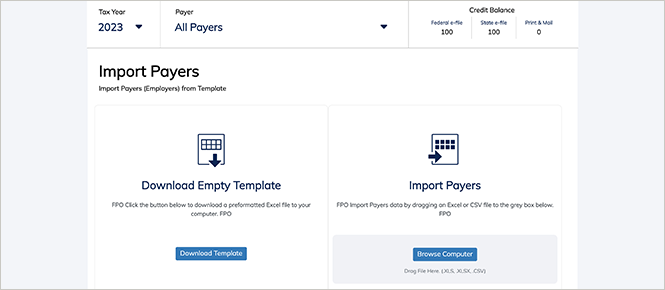

Importing is easier than ever

Our import from last year feature lets you copy over last year’s Payers, Recipients and Forms in one click.

PDF File Sharing

Send secure links directly to employees with just a few clicks.

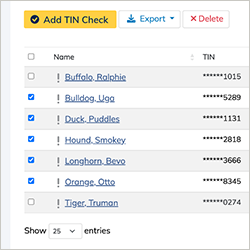

TIN Check Service

This powerful add-on service matches your employee tax IDs against the IRS database.

Optimal Import tools

Import from Quickbooks Online, Microsoft Excel, or CSV files.

Peace of Mind

TLS encryption meets military standards for security and safety.

Spot-on data

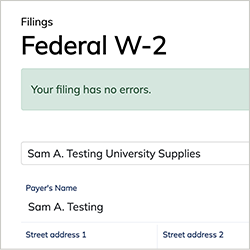

Improved error-checking features help you check your data for precision and accuracy.

eFile directly to the IRS / SSA

File taxes electronically, without leaving your desk. It’s fast, safe, and if you’re filing 10 or more forms, it’s required by the IRS!

Faster, safer, web-based business taxes.

Adams provides the security and convenience you expect from an online tax services provider.

No downloads or updates

Since we’re web-based, we’re always current. There’s nothing to install. Just pull us up on your web browser. When you’re ready to log in, we’re ready to work.

Safe and secure

Tax Forms Helper® stores your data using layers of security. Network firewalls & 256-bit AES encryption offer military-grade, classified data storage.

We transmit your data with TLS encryption standards that exceed IRS requirements.

Ready, set, print.

With your data ready, you can print directly onto genuine Adams tax forms with an Inkjet or Laser printer. Our PDF printing guidelines help you produce precisely aligned forms with ease.

eFilers simply print copies for employees and recipients as needed. You'll get professional-looking forms from your laser or inkjet printer.

More Accurate Taxes

With smart error-checking tools and TIN verification

New Error-Checking Tools

Our improved Helper site checks for typos, missing information, and other errors before you submit, so you can fix and file your taxes with confidence.

New TIN Check Service

- An add-on service that accurately validates employee ID numbers / names against the IRS database.

- Accurate TIN Check helps you avoid financial penalties, up to 280 dollars per form with an incorrect TIN.

- TIN Check is available for purchase on the new Helper.

Prepare Common Tax Forms.

You can eFile your W-2 and W-3 forms to the SSA, eFile your 1099-MISC, 1099-NEC, 1099-INT, 1099-DIV, 1099-R, 1099-S, 1098, 1098-T, and 1096 forms to the IRS, and eFile forms to select states. 10 or more forms? You’re required to eFile!

Wage and Tax Statement Forms

W-2

Wage and Tax Statement Form

W-3

Summary Transmittal Form for the W-2

Miscellaneous Income Forms

1099-MISC

Miscellaneous Income Form

1099-NEC

Nonemployee Compensation Form

1096

Summary Transmittal Form for the 1099

Other Income

1099-INT

Interest Income Form

1099-R

Retirement Distributions Form (for Pensions, Annuities, Profit-sharing, IRAs, Insurance Contracts, etc.)

1099-DIV

Dividends and Distributions Form

1099-S

Proceeds from Real Estate Transactions

Mortgage & Tuition Statements

1098

Mortgage Interest Statement

1098-T

Tuition Statement

Corrected Wage & Tax Statements

W-2C

Corrected Wage and Tax Statement

W-3C

Corrected Transmittal of Wage and Tax Statement

eFile corrections now available for all forms except the 1098-T